Information-Only Resource

Interest-Free & Akhuwat

Loan Information in Pakistan

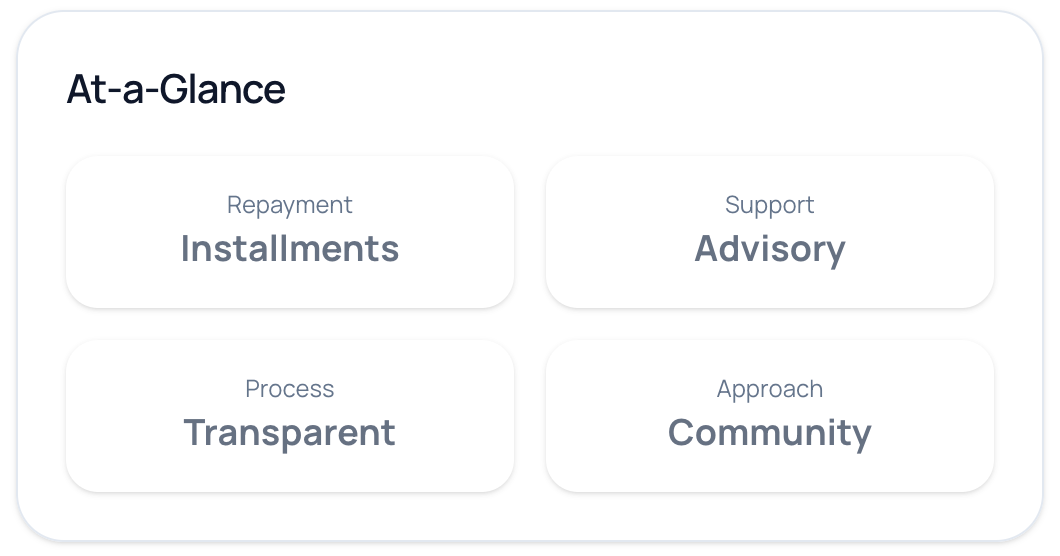

Learn how organisations like Akhuwat-inspired models support communities with interest-free microfinance. We explain eligibility, documents, and timelines so you can make informed decisions. We do not provide loans.

Processing depends on verification; timelines vary by organisation.

Akhuwat Loan Scheme Information & Guidance Program

Akhuwat is known for community-based financing models. Public information shows that applicants may experience different timelines depending on eligibility and verification. Some welfare programs also mention flexible funding schedules, but these processes are always managed directly by Akhuwat and other official organisations. Our role is only to share knowledge about these practices.

Our Mission & Vision

Our Misson

Our mission is to guide individuals with accurate and clear information about welfare-based loan programs like Akhuwat. We aim to empower students, families, and entrepreneurs with knowledge so they can apply confidently for interest-free loans through official channels.

Our Vision

Our vision is to create a trusted knowledge hub where communities can learn about eligibility, documentation, verification processes, and repayment structures. By sharing details and resources, we help people make informed decisions that uplift their lives.

How Akkhuwat Welfare-Based Schemes Typically Work

A general overview for knowledge purposes. Always confirm details with official organisations.

1. Initial Interest

Understand the program’s purpose and check general eligibility.

2. Documents

Prepare CNIC, residence & income proofs. Requirements vary.

3. Verification

Community-based appraisal is common in trust-driven models.

4. Disbursement

If eligible, funds may be released; timelines differ by organisation.

Why These Models Matter

Interest-free financing can empower households and small businesses while strengthening community bonds.

0% markup; Shariah-aligned intent.

Community and trust-based verification.

Focus on dignity, inclusion, and opportunity.

Education, micro-enterprise, healthcare & housing support.

Who Can Benefit

Different groups can benefit from welfare-based loan schemes. Students may cover tuition and exam fees, small entrepreneurs can get seed or working capital, households can manage healthcare or emergencies, and families may access support for housing needs.

Students

Tuition, books, exam fees (program-dependent).

Micro-Entrepreneurs

Seed capital & working capital support.

Households

Healthcare & emergency needs.

Housing

Construction/renovation (where applicable).

Guides & Resources

Eligibility & Documents

Most schemes require a valid CNIC (Computerized National Identity Card).

Proof of residence such as utility bills or rental agreements is usually needed.

Some programs also ask for income verification or guarantor details.

Additional requirements may vary depending on the specific program.

How Verification Works

Verification often involves local community appraisal or references.

Organisations may check employment, household income, and character through community members.

The goal is to ensure the applicant is genuine and falls within the intended support criteria.

Timelines differ — some verifications are quick, while others may take weeks.

Interest-Free Repayment

Repayment is usually done in small, manageable installments.

No interest or markup is charged — repayment is equal to the original loan amount.

Staying regular with payments helps applicants maintain a good standing for future support.

Defaulting can make it difficult to access future welfare programs.

Frequently Asked Questions

This platform is an independent knowledge hub. Our role is to explain how different welfare-based or interest-free loan programs generally work, what their eligibility rules are, and how people can learn about them. We do not arrange, approve, or provide any loans directly — all applications must always be submitted through the official organisations.

The time required for financial assistance depends entirely on the official organisation’s internal process. Factors such as eligibility checks, community verification, and document review can influence the speed. In some cases, processing may be relatively fast, while in others it may take longer. We only provide guidance about the process, and do not control timelines or approvals.

No, we are not officially affiliated with Akhuwat or any other financial institution. Our purpose is to share educational content that explains how such welfare-based models typically operate. We may reference well-known programs (such as Akhuwat) for learning purposes, but all trademarks and official processes belong solely to their respective organisations.

Eligibility depends on the organisation offering the program. Generally, students, small business owners, households, or individuals with limited income may qualify. Each institution defines its own criteria, so it’s important to carefully review the official guidelines before applying. Our role is to provide general knowledge about these requirements, not to determine eligibility.

Most programs ask for a few common documents such as:

A valid CNIC (Computerized National Identity Card).

Proof of residence (utility bill, rental agreement, or equivalent).

Evidence of income or a guarantor, depending on the scheme.

Requirements may differ between organisations, and users must always confirm directly with the official institution.

What People Say

Real experiences from Pakistan — our guidance helped them understand the process and apply with the official organisations.

- ★★★★★

“Their guidance helped me understand how to apply for an Akhuwat loan successfully.”

Ahmed RazaLahore - ★★★★★

“I was confused about the documents, but they explained everything clearly step by step.”

Ayesha KhanKarachi - ★★★★★

“Because of their support, I was able to complete the requirements and move forward.”

Bilal AhmedRawalpindi - ★★★★★

“They gave me clear information that made the whole process easier to understand.”

Fatima NoorFaisalabad - ★★★★★

“Without their advice, I might not have been able to apply correctly.”

Hassan AliMultan - ★★★★★

“The WhatsApp guidance was quick and very helpful, all my questions were answered.”

Rabia MalikHyderabad - ★★★★★

“This site gave me real knowledge about Akhuwat programs that I didn’t know before.”

Salman YousafPeshawar - ★★★★★

“Mujhe Akhuwat loan ke options ka detail yahan se samajh aaya, helpful resource hai.”

Mehwish TariqQuetta - ★★★★★

“First time apply kar raha tha, inhon ne mujhe confidence diya aur sahi direction dikhayi.”

Usman SiddiqSialkot - ★★★★★

“Process ka timeline aur requirements clear karne ki wajah se mera kaam jaldi ho gaya.”

Hira QureshiBahawalpur - ★★★★★

“The best thing is they provide information only, very transparent and reliable.”

Hamza IqbalGujranwala - ★★★★★

“Strictly information-only, yet extremely useful. I later received assistance from the official program.”

Sana JavedSukkur - ★★★★★

“Clear roadmap for micro-entrepreneurs. Helped me submit a complete application.”

Imran RafiqKasur - ★★★★★

“I finally understood the loan categories and terms through their content.”

Komal ShahLarkana - ★★★★★

“Repayment and installment info gave me confidence. Later my case was accepted.”

Zeeshan ArifSahiwal - ★★★★★

“They helped me prepare correctly; the official organisation handled approval.”

Nida RahmanMardan - ★★★★★

“I got clarity on rules and verification steps that I had no idea about before.”

Waqar HussainSheikhupura - ★★★★★

“Because of their guidance, my application was smoothly submitted through the official channel.”

Mariam ZafarAbbottabad - ★★★★★

“No marketing tricks — just real information that helped me.”

Farhan WaheedJhelum - ★★★★★

“Got clarity on documents and verification. Later my application succeeded.”

Bushra KhalidWah Cantt

*We provide information and guidance only. Approvals and timelines are decided solely by the official organisations; individual outcomes can vary.*